The Hang Seng Composite Small and Mid-Cap Index did not post the best of performance this year. From January 2018 to end-September, the index fell more than 15 percent, underperforming the benchmark Hang Seng Index or the HSI. According to UOBKH, the underperformance is attributable to the weaker trading liquidity, corporate governance risk and less defensive nature of small and mid-caps compared to the blue chips.

Going Defensive

In light of the adverse macro environment, UOBKH recommends that investors take a back seat with the aggressive strategy of pursuing growth for small and mid-caps. Instead, investors should look out for resilient small and mid-caps with good risk-reward profiles. There are three strategies that UOBKH recommends which will allow investors to build a resilient portfolio in the current investment climate.

Investors Takeaway: 3 Investment Strategies To Find Gems In China

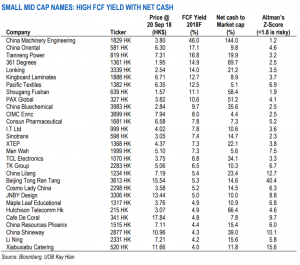

- Cash Is King

In the wake of slowing economic growth in China and tighter market liquidity, small and mid-cap companies with strong cash generation capability and net cash balance are deemed as more defensive. In order to screen for such stocks, UOBKH uses a free cash flow (FCF) yield of at least four percent and net cash position to sieve out these defensive small and mid-caps. Within UOBKH’s universe of coverage, there are 29 small and mid-cap stocks that fit the defensive stock profile.

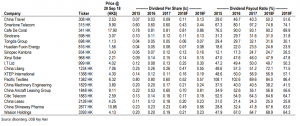

- Dividend Speaks Volume

Given UOBKH’s expectation that there could be an economic downcycle, a key criterion that UOBKH looks out for is the resilience to a downcycle. UOBKH believes that companies with steady dividend per share (DPS) are the ones to build your resilient portfolio around. These companies, termed as steady DPS companies, need to either having positive DPS growth in the past four years or not more than one year when DPS was more than 20 percent below its five-year DPS mean. There are 18 small and mid-cap dividend plays that UOBKH considers as steady DPS companies with limited downside risk to future DPS.

Defensive Plays With Positive FCF And Dividends

Another strategy that UOBKH recommends is to invest in stocks that possess both positive free cash flow (FCF) and high dividends. There are five small and mid-cap stocks that UOBKH picked under this investment strategy:

- China Shineway

China Shineway is a TCM play with three growth catalysts: Oral formulation TCM medicine; TCM formula granule; and the opening up of grassroots healthcare institution procurement limits. With a net cash position of HK$3.6 billion in cash, UOBKH foresees no pressure in China Shineway paying out dividends in the upcoming quarters.

BUY, TP HK$17.72; current share price HK$9.72

- China Oriental

China Oriental is a beneficiary of the potential acceleration of China’s fiscal spending in 2H18 and less steel production cut this winter. The company is currently deeply undervalued at 1.1 times FY18 price-to-book value and 3.5 times FY18 price-to-earnings, according to UOBKH.

BUY, TP HK$8.79; current share price HK$5.84

- I.T

I.T is a strong candidate to ride on Hong Kong’s turnaround story, gross margin expansion through cutting promotions activities and higher online sales contribution in China in the near term. With better cost control and solid sales momentum, I.T should be able to sustain its 50 percent dividend payout ratio. That being said, further upside in payout ratio should be limited.

BUY, TP HK$5.60; current share price HK$3.58

- TK Group

At its current share price, TK Group offers an indicative dividend yield of 3.6 percent and FCF yield of 3.8 percent. Driven by the booming smart electronic consumer products and deeper penetration into the US internet and smartphone giants, investors can expect TK Group to register decent growth in the next few years. This will help TK Group to sustain its FCF and dividend yield.

BUY, TP HK$7.25; Current share price HK$4.05

- Xiabuxiabu Catering Management

Xiabuxiabu Catering Management (XCM) is a resilient play on China’s domestic consumption despite the expected slowdown. UOBKH notes that the company would continue to gain share in China’s fragmented catering and hotpot industry. Given its strong free cash flow generating capability, XCM’s share price should remain resilient.

BUY, TP HK$13.55; HK$10.48

The benefits of outsourcing business process improvement can be substantial. In addition to saving your company money, outsourcing your business process improvement is more convenient and flexible than ever. For more details about business process management, pop over to these guys.

ReplyDeleteThe benefits of outsourcing business process improvement can be substantial. In addition to saving your company money, outsourcing your business process improvement is more convenient and flexible than ever. For more details about business process management, pop over to these guys.

ReplyDeleteBy implementing business process improvement solutions, employees can focus on the customer and their needs rather than on administrative tasks. This leads to a more productive workforce and satisfied customers. If you are curious to know more about business process management, check here.

ReplyDeleteBy implementing business process improvement solutions, employees can focus on the customer and their needs rather than on administrative tasks. This leads to a more productive workforce and satisfied customers. If you are curious to know more about business process management, check here.

ReplyDelete